overapplied manufacturing overhead would result if:|calculate over or underapplied overhead : Bacolod Definition: Overapplied overhead is excess amount of overhead applied during a production period over the actual overhead incurred during the period. In other words, . We are OPEN on August 6, 2018(Mon.)- It's Holiday in observance of Cebu Foundation Day. For those who would like to have an ocular visit, please come.

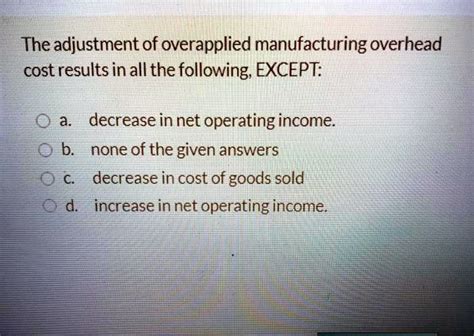

overapplied manufacturing overhead would result if:,The answer is manufacturing overhead costs were less than or greater than the charges to production. The web page provides a detailed solution from a subject matter expert and a transcribed image text. The . Overapplied overhead occurs when the total amount of factory overhead costs assigned to produced units is more than was actually incurred in the period. .Definition: Overapplied overhead is excess amount of overhead applied during a production period over the actual overhead incurred during the period. In other words, . If manufacturing overhead has a credit balance, the overhead is overapplied, and the resulting amount in cost of goods sold is overstated. The .

Overapplied overhead is the result of the manufacturing overhead costs that are applied to the production process is more than the actual overhead cost that actually incurs .overapplied manufacturing overhead would result if: calculate over or underapplied overheadOverapplied factory overhead represents a surplus of allocated costs that were not actually incurred during the period. It can impact the accuracy of product costs and may .

If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead. A debit balance in manufacturing .

Accounting questions and answers. Overapplied manufacturing overhead would result if: Multiple Choice the plant was operated at less than normal capacity. manufacturing overhead costs incurred were greater than manufacturing overhead costs charged to production. manufacturing overhead costs incurred were less than estimated .

Reasons for Overapplied Overhead. Overhead costs are the indirect costs of running a business, such as supplies, lighting and other utilities. They cannot be readily traced to results. Applied . Underapplied Overhead: An accounting record in cost accounting where the overhead costs assigned for a work-in-progress product does not reach the amount of the actual overhead costs. . Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. The adjusting journal entry is: Figure 4.6.5 4.6. 5: Application of underapplied overhead to cost of goods sold. If the overhead was overapplied, and the actual overhead was $248, 000 $ 248, 000 and the applied .Overapplied overhead is the result of the manufacturing overhead costs that are applied to the production process is more than the actual overhead cost that actually incurs during the accounting period. . In this case, the manufacturing overhead is overapplied by $500 ($10,000 – $9,500) as the applied overhead cost is $500 more than the .overapplied manufacturing overhead would result if: How do you calculate applied manufacturing overhead? To calculate calculate applied manufacturing overhead: Step 1: Choose a cost object such as a product or a department. Step 2: Determine total .

II. Overhead can be applied when the job is completed. III. Overhead should be applied to any job not completed at year-end in order to properly value the work in process inventory. D) Statements I, II, and III are all true. A) Manufacturing Overhead. B) Finished Goods. C) Work in Process. D) Cost of Goods Sold.Question: Underapplied manufacturing overhead would result if: Manufacturing overhead costs incurred were more than estimated manufacturing overhead costs. The manufacturing facility was operated at more than normal capacity, O Manufacturing overheati costs incurred were more than manufacturing overhead costs applied to the .Overapplied overhead would result if Select one: a. overhead costs incurred were less than costs charged to production. b. overhead costs incurred were greater than costs charged to production. . Manufacturing Overhead Control 2,300 Raw Material Inventory 500 Wages Payable 1,800 To record rework costs b.Step 1. Given the MCQ question - Overapplied overhead will result if. a) Overhead costs incurred were greater . View the full answer. Step 2. Unlock. Unlock. Step 3. Unlock.

If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: To adjust for overapplied or underapplied manufacturing overhead, some companies have a more complicated, three-part allocation to work in process, finished goods, and cost of goods sold.

In that case, the underapplied overhead journal entry will include two more accounts as below: Similarly, the work in process inventory account and finished goods inventory account will also be added in the overapplied overhead journal entry. At the end of the accounting period, when the company has a debit balance of manufacturing overhead, .

Our community brings together students, educators, and subject enthusiasts in an online study community. With around-the-clock expert help, you can find the help you need, whenever you need it. In this session, I discuss underapplied and overapplied manufacturing. For more visit: www.farhatlectures.com#cpaexam #managerialaccounting #acountingstudentStep 1. The correct answer is b. Manufacturing overhead costs incurred were more than manufacturing overhead. Underapplied manufacturing overhead would result if: O The manufacturing facility was operated at more than normal capacity, Manufacturing overhead costs incurred were more than manufacturing overhead costs applied to the .

Question 7 2 pts 7) Overapplied manufacturing overhead would result if: A) the plant was operated at less than normal capacity. B) manufacturing overhead costs incurred were less than estimated manufacturing overhead costs.

Accounting. Overapplied factory overhead would result if: a. The plant was operating at less than normal capacity b. Factory overhead costs incurred were less than costs charged to production c. Factory overhead costs incurred were unreasonably large in relation to units produced d. Factory overhead costs incurred were greater than costs .calculate over or underapplied overheadIf the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: To adjust for overapplied or underapplied manufacturing overhead, some companies have a more complicated, three-part allocation to work in process, finished goods, and cost of goods sold.

overapplied manufacturing overhead would result if:|calculate over or underapplied overhead

PH0 · when overhead has been overapplied

PH1 · overapplied overhead formula

PH2 · manufacturing overhead applied journal entry

PH3 · manufacturing overhead applied calculator

PH4 · journal entry for overapplied overhead

PH5 · how to calculate underapplied overhead

PH6 · how to calculate manufacturing overhead

PH7 · calculate over or underapplied overhead

PH8 · Iba pa